- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

President Signs into Law CR for FY 2021; Forbearance Issues with RD; Additional COVID-19 Relief Legislation

CARH’s BROADCAST EMAIL – Legislative & Regulatory Update

1) President Signs into Law Continuing Resolution for FY 2021

Just after midnight today, President Trump signed into law H.R. 8337 – Continuing Appropriations Act, 2021 and Other Extensions Act (Public Law number has yet to be assigned). This legislation is a short-term Continuing Resolution (CR) for Fiscal Year (FY) 2021 and will keep the federal government funded through December 11, 2020. The stop gap funding bill passed the House by 359-57 on September 22 and the Senate by 84-10 on September 30.

2) Forbearance Issues with Rural Development

As CARH members know, the CARES Act (Public Law 116-136) allows multifamily borrowers to request forbearance if they are experiencing financial hardship due to COVID-19. Rural Development (RD) has existing authority in 7 CFR §3560.453 to take special servicing actions as part of a workout plan on Section 514 and 515 loans to prevent a default, and under that authority will approve a deferral of up to 3 monthly loan payments. We understand there were 4,100 Rural Rental Housing multifamily mortgage forbearance requests due to COVID-19 related issues.

RD indicated to borrowers that they could submit forbearance requests orally or in a written format to their assigned multifamily servicing official. Once this information is submitted, the request is to be processed within five business days by the field office and sent to the National Finance, Accounting and Operations Center (NFAOC) in St. Louis to adjust accounts accordingly. If loan payments are normally offset against your Rental Assistance (RA) payment, owners should have received full RA payments without the mortgage payment deducted.

Unfortunately, this has not been a smooth process and there are many owners who requested and received forbearance but have not received RA payments for several months. CARH has been in constant communication with the national RD office to help solve what appears to be a software problem at the NFAOC. While progress on the software repair has been relayed to CARH, issues remain. It may be several more weeks before RA payments will automatically be deposited in properties accounts.

Owners do have a couple of options while awaiting the software fix:

- If you have sufficient reserve accounts, you can borrow against those accounts; or

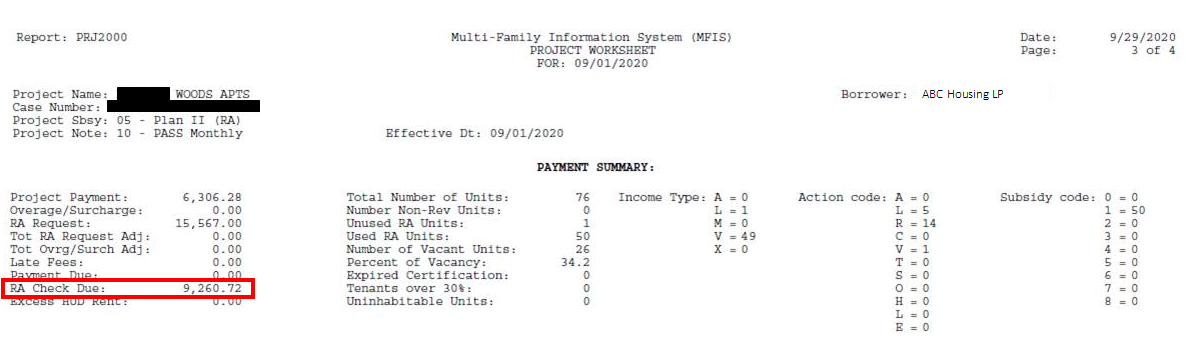

- For any properties with a reserve balance under $10,000, owners should reach out to their assigned servicing specialist and request a manual release of their RA payment. It helps if owners have completed your project work sheet (PWS) and know exactly what the net RA is. If not, the servicing specialist can look it up. Below is a screen shot for reference:

CARH will continue to work with RD and urge them to quickly resolve the issue. At the same time, it is apparent that RD needs to have additional monies to fix what appears to be very antiquated IT systems. Additional monies were requested in the budget and CARH has strongly urged additional monies be added in the FY 2021 budget for that purpose.

3) Additional COVID-19 Relief Legislation

On September 29, House Democratic leadership released a scaled down COVID-19 relief proposal, calling it an updated The Heroes Act, with a price tag of $2.2 trillion. The bill is approximately $1 trillion less than the earlier version and includes new relief for the airline, restaurant, and other hardest-hit industries, as well as additional funds to support education, childcare, and expansion of the Paycheck Protection Program (PPP). Negotiations between the White House and House and Senate are very fluid as we write this email. According to several sources, negotiators are only $500 billion apart. If agreement cannot be reached, it is likely that the House will vote separately on the bill introduced on Tuesday and then leave Washington until after the November 3 Presidential and Congressional elections.

The new proposal does not include any of the Housing Credit or Housing Bond provisions, i.e. flat 4% rate for Housing Bonds that has been widely supported by the affordable housing groups, including CARH. Members will recall that the original HEROES Act (H.R. 6800) also excluded Housing Bonds along with other “industry specific” tax credit provisions. H.R. 2, the Moving Forward Act, that would provide infrastructure spending, contains those provisions.

Though the new Heroes bill does not include the full amount of housing resources proposed in the original, it would authorize substantial new funding for rental assistance.

A summary of key housing provisions is below:

- $309 million for the Section 521 Rental Assistance program which would allow for current non-RA residents to receive funding (as in the original Heroes Act proposal);

- $50 billion in emergency rental assistance (down from $100 billion in the original Heroes Act);

- $21 billion to create a homeowner assistance fund (down from $75 billion in the original Heroes Act);

- $5 billion in Community Development Block Grants;

- $5 billion in Emergency Solutions Grants homelessness grants (down from $11.5 billion in the original Heroes Act);

- $4 billion for Tenant Based Rental Assistance;

- $2 billion for Public Housing Operating Fund;

- $2 billion for CDFIs to respond to COVID in distressed communities;

- $750 million in Project Based Rental Assistance;

- $500 million for housing for the elderly;

- $45 million for housing for persons with disabilities (down from $200 million in the original Heroes Act); and

- Extending and expanding the eviction moratorium and foreclosure moratorium in the CARES Act to include all renters and homeowners.

Please contact the CARH national office at carh@carh.org or 703-837-9001 should you have questions.